Hello. Today we look at how wealth levels are changing across generations in America, two trends in Latin America and why learning economics can close gender pay gaps.

They Got Their MTVs

For a peer group associated with nihilistic grunge music, things have turned out pretty well for Generation X. Especially during the pandemic.

Since Covid-19 struck, U.S. household wealth distribution has shifted from older generations to those who are reaching their peak earnings years — especially the oft-overlooked demographic group squeezed between the Baby Boomers and Millennials, Alex Tanzi reports.

Gen Xers, aged 41 to 56, saw robust gains in equities and pension entitlements, while their share of the nation’s consumer debt declined, the data show.

It marks a rebound of sorts for the cohort that was worst-hit by the 2008 financial crisis. Millions of Gen Xers, who were in their 30s and early 40s at the time, lost jobs and housing wealth.

- Generation X held 28.6% of the nation’s wealth as of June, up 3.9 percentage points from the first quarter of 2020

- Their total net worth — the surplus of assets over debt — soared 50% in that period

- This group, some 34.6 million households in all, added $13 trillion in assets over 15 months, almost 2/3 more than the Boomers, who are notably more numerous

The powerful rally in the stock market, along with a surge in house prices, helped propel this surge in wealth for the MTV generation, along with — to a lesser extent — that of other age groups as well.

But Americans have also been socking more away during the pandemic. All in all, U.S. households now have $2.5 trillion more in personal savings than would have been expected looking at trends prior to Covid-19, according to analysis by JPMorgan Chase & Co.

Savings are one metric where Gen Xers have been outdone by their parents. Baby Boomers have accumulated more than $1.6 trillion in excess savings in the past two years, Fed data show, more than twice as much as for the cohort that grew up in an era of conspicuous consumption, watching Miami Vice and music videos on MTV.

Over the coming decades, the prospect is for an outsized transfer of wealth from the Boomers to Gen X, along with younger generations.

- Got tips or feedback? Email us at ecodaily@bloomberg.net

- For the latest on how companies and institutions are confronting gender, race and class, subscribe to the Equality newsletter

The Economic Scene

We have two must-read insights into Latin America today.

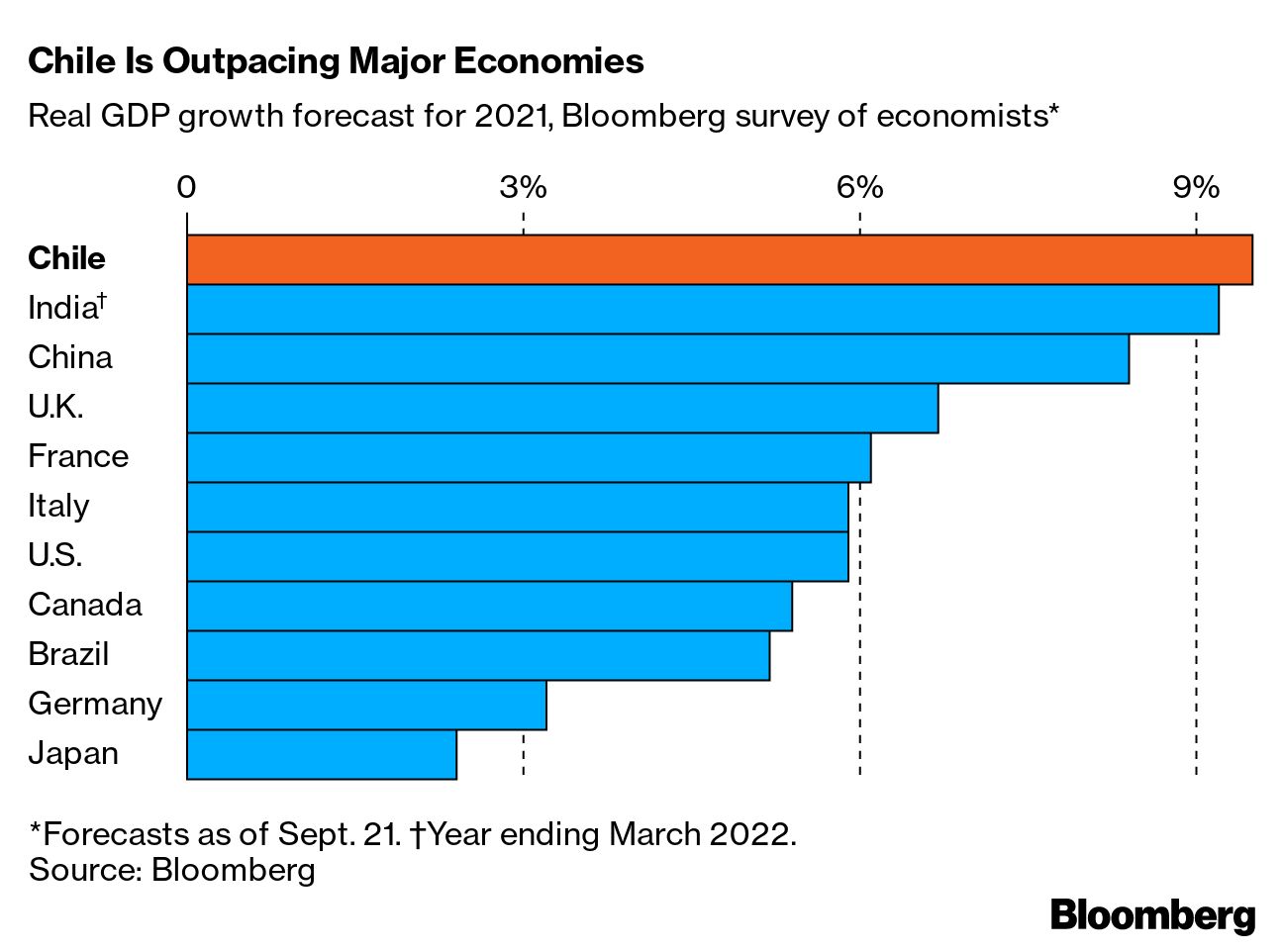

Firstly, the Bloomberg Big Take looks at Chile and how its fast-rising left-wing political movement is part of a broader shift across Latin America.

It is rattling international corporations and investment firms, which have long favored Chile as perhaps the most market-friendly developing economy in the world.

Secondly, Brazil’s central bank is having some success with Pix, a system which allows fast money transfers over smartphones. It has become ubiquitous in the 11 months since it was launched and has already been used at least once by 110 million Brazilians.

Read more here.