There is a growing fear that the costs of global reach, in terms of regulation and complexity, exceed the potential benefits. ~The Economist, March 7th 2015

We are slowly beginning to understand the complexity of the corporate system, which today, for better or for worse rules the planet. On one hand, at the intrafirm level, gigantism leads to inextricable bureaucracies, generating a chaotic behavior and systemic risks. On the other hand, the same giants are providing for interfirm structures of systemic connectedness, quite similar to governments in the sense of internal control hierarchy and practice of direct political power. The result is an extremely complex bureaucratic architecture, both intra– and inter-corporate, feeding the “growing fear” mentioned above. Understanding this world of giant mushrooms is now vital.

When the name of the Black Rock corporation appears on the cover of the Economist, managing some 14 trillion dollars, almost equivalent to the GDP of the United States, we have to adjust our concepts. Is it indeed the State that has become an uncontrolled giant? What happens when corporations become more gigantic than the States themselves? Closing the year 2015, The Observer notes that “takeovers, mainly originating from the USA or the Far East, broke records in terms of values of the business deals carried out, reaching a total of US $ 4.6 trillion in early December. According to Dealogic data, in 2015, there were nine business deals of over a US $ billion each, five more than in 2014 “. (Observer, December 28th 2015.)

A basic conclusion is unavoidable: over so many years of corporate concentration, through mergers and acquisitions, we have created giants which present new management challenges. The post-2008 regulatory measures have not brought about anything new in terms of control or governance, but rather stimulated a series of studies on the dynamics. We are beginning to understand the mechanisms and the operational logic of corporate giants.

In recent years, the first in depth research on the world-wide corporate control network was published by the Swiss Federal Institute of Technology. It identified 147 groups that control 40% of the global corporate system, 75% of them banks (Vitali). We now also have a clearer picture of traders, 16 groups that control nearly all the commodities on the planet (Schneyer). With rare exceptions they are based in Switzerland, and are responsible for the dramatic commodity price variations of essential products in the entire world economy, such as grains, metallic and non-metallic minerals, and energy. (Dowbor, Producers…2014)

TJN (Tax Justice Network), ICIJ (International Consortium of Investigative Journalism) and The Economist itself shed some light on tax havens and illicit or illegal international transfers. For example, identifying about 520 billion dollars of Brazilian source (a stock of about one-third of our GDP) and more than 20 trillion worldwide (for a global GDP of 73 trillion in 2012). GFI (Global Financial Integrity) presents data on international misinvoicing or transfer pricing, which costs Brazil about 2,5% of its GDP every year, and about 60 billion dollars annually for Africa.

Crédit Suisse, which is well placed to know everything about fortunes, because it helps manage them, shocked the entire planet with these simple figures: 62 families have a net worth equal to the poorest half of the world population, a direct result of the financial mechanisms. (Oxfam) If in Marx’s time the added value was drawn company by company, today, this added value is drawn through global mechanisms, even beyond the regulatory power of state. With these and other studies, the veil on the uncontrolled giant that rules us is gradually lifting. We come closer to understanding, not only the general theory of financialization, but the gears of its operation, with names and figures.

Several theoretical studies, in particular by François Chesnais, had already outlined the dynamics. Noteworthy is the pioneering work of this new generation of studies, by David Korten, in his now classic When Corporations Rule the World (1995), as well as the documentary The Corporation. Others followed, Inside Job, The Four Horsemen, as well as fiction films like Le Capital, a movie where the only fiction are the characters. Actually resorting to fiction may be the best way to get closer to reality. With these and other efforts, a wider awareness of what is going on gradually emerges. Piketty’s work, – The Capital in the 20th Century – , had such an impact, not only for literary and scientific quality, but because it unraveled the gears of the organized chaos that rules us. We are facing a new political, economic and cultural logic.

This is by far the main process that generates the present global instability and disorganization. It is worthwhile to systematize what recent research is showing, because if the 2008 crisis had any advantage it was to shed some light on the mechanisms. Many things are becoming clearer. Here, the focal points of interest are three recently published studies that contribute to the understanding of both the power and the chaos generated by corporations gulping down whatever passes by, and which end up having much on their desk than the actual capability of management and control, let alone rational investment policies: research by Lumsdaine and others on intrafirm complexity, by François Morin on the banking oligopoly, and by Nicholas Shaxson on tax havens.

The intrafirm management crisis

A particularly interesting study is -The Intrafirm Complexity of Systemically Important Financial Institutions – , inter-university research in the United States and other countries, coordinated by Lumsdaine and others. The research centers on the concept of ‘control hierarchies’ of 28 planetary giants, the famous corporations classified as “systemically important.” These are institutions “whose disorderly failure, because of their size, complexity and systemic interconnections, would cause significant disruptions to the broader financial system and economic activity.” (Lumsdaine, 1) The research focuses essentially on the internal decision-making process of these economic galaxies, particularly the control hierarchy, defined as “a network representation of the institution and its subsidiaries.” (Lumsdaine, 1)

This approach is quite different from the research on the worldwide corporate control network that we have seen above, prepared by the Swiss Federal Institute of Technology, which shows the intercorporate control system. We will come back to this dimension in the next part of this paper, which focuses on publications by François Morin. Looking at the internal structure of these corporations reveals extreme complexity and bureaucratic depth. Such a corporation may buy a company in the food sector, for example, but also have interests in different mining companies, as well in dozens of others in whatever sector offers an opportunity for profit, without having a particular expertise in the activities in which they invest. This brings us to the concept of ‘intraconnectedness of a firm’, another key concept in the adopted methodology. (Lumsdaine, 2) “Ours is a novel approach that uses the innate network structure of the control hierarchy. In doing so, we therefore highlight the importance of considering intra-firm complexity in addition to the more commonly-studied inter-firm complexity (i.e., the interconnectedness across firms)”(Lumsdaine, 3)

What size are we talking about? The 29 financial corporations classified as SIFIs (Systemically Important Financial Institutions), each work with an average consolidated assets of around $ 1.82 trillion for banks and $ 0.61 trillion for the analyzed insurance companies. (11) For comparison remember that the USA GDP is around 15 trillion dollars, Brazil’s GDP, 7th world power, around $ 1.4 trillion. More explicit still is to recall that according to Jen Martens’ data, the UN system has 40 billion dollars per year for all of its activities, which in turn represents only 2.3% of global military expenditures. (GPF, 2015)

In the absence of a world government, and with national government capacity fragmented into 193 nations, any regulation or planning of what is taking place on the planet seems to be out of our reach. This opens the ground for a global free-for-all: these are trillions of dollars in the hands of private groups whose field of action is the planet, while the capabilities of global regulation barely crawl. The really existing world power is largely in the hands of giants that no one elected, and upon which there is less and less control. They manage funds at least as important as governments.

How these institutions are managed, therefore takes on major significance. Altogether, they handle something like 50 trillion dollars, equivalent to the total public debt of the planet. We do not know very well what they do, since not even a minimal fee on transactions that would allow mapping the flows is accepted. What is more surprising, as documented in this research, is how little the people at the top of the corporate pyramid understand what is happening with their own operations, owing to the very gigantism, multi-layered complexity and dispersion of activities.

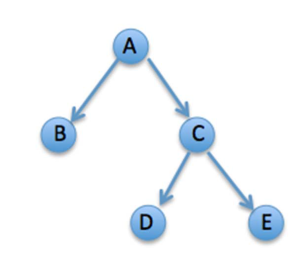

The image of the tree below helps to understand the logic of the research. In a given corporation, company A is marked as the group root, which controls two subsidiaries B and C, which in turn controls the D and E. These two subsidiaries, as they do not control other companies, are here called “leaves,” the outer end of the tree. The subsidiaries B and C are called “pups” in relation to A, which is now “mother”. This structure is regular, with each unit controlling two below, and has a depth “two”, the distance of A to the nodes B and C. Thus we have a structure with more or less depth, more or less scattered “leaves” and more or less crossed or overlapping controls, which is very common. (Lumsdaine, 27)

To have an idea of ??the complexity, “the number of nodes in the tree varies from 330 to 12,752, while the number of different countries and SIC codes (Standard Industrial Classification) ranges from 23 to 86 and from 27 to 164 respectively “. (Lumsdaine, 10) That is to say, these are corporations that control thousands of companies in dozens of countries and often encompass way over a hundred different economic activities. These are galaxies with an extremely restrained control capability, which in turn means that the financial outcome is the bottom line, or only common denominator, for a “mother” corporation to judge the efficiency of some distant “leaf” out of some office in Geneva.

We have got used to the daily news on problems of governance, with corporate fraud, corruption or mismanagement, frequently outweighing the public sector problems. This is substantiated by the fact that virtually all of them are paying billions of dollars of fines for large scale illegal activities. Many apologies on the part of those in charge of the control of these corporations, who allege they “were not aware” of the scale of fraudulent activities, may indeed just be excuses. What is of greater concern, however, is that it is perfectly possible that they really do not know what is going on in the giant they theoretically steer. Thus we carry the whole price of huge bureaucracies, but without even the little political control ensured by democracy in the public sector. And of course, governments are supposed to work for the public good, while the corporate world has no such concerns, since it is legally bounded to pursue profit for the owners.

Here, in the 29 large systemically significant institutions, we are dealing with a growing bureaucratic depth: “In addition, 11 firms now have more than seven levels while just two years earlier, none did. Across all firms in the sample, by 2013 roughly 25% of the nodes were at deeper than the third level. Thus from the perspective of consolidated supervision, the challenges associated with assessing these firms increased dramatically, with many entities in the organization being much farther removed from the parent.” (Lumsdaine, 11) In other words, financial corporate giants are becoming more centralized and bureaucratic: “The increased degree depth is an indication of a shift toward a more bureaucratic organizational structure.” (Lumsdaine, 14)

Source: Jacob Aron – Capitalism’s hidden web of power, New Scientist, May 23, 2015

What we see in the figure above is the immense complexity of the corporate governance system. As customers and mere mortals, we only see the unit on the top, the credit card in our hands or the product we see in a supermarket gondola. The product seems fairly simple, but we cannot follow the gigantic bureaucratic tangle and disarray that take place in the system. Moreover, the number of controlled sectors (manufacturing, mining, trade, finance and insurance, public administration etc.) by one group is amazing.

Consider the pyramid of the corporate decision-making process, where ”an institution that concentrates its decision-making among only a few senior managers who are then held accountable for large portions of the firm would have a larger proportion of nodes at lower levels of the tree. Such a diffuse tree might also be found among organizations that have experienced significant growth by acquisition, such as many financial institutions in the decade preceding the recent financial crisis, where the tree of an acquired complex organization may have been grafted to the tree of the acquiring parent somewhere below the highest level, creating a very hierarchical structure of great depth (a “bureaucratic” structure). 11 Firms also might be arranged along geographical (“divisional”) or industry (“functional”) lines.” (Lumsdaine, 10) Here, we are in the center of the problem of structural bureaucratization that permeates the entire decision- making process within a corporation.

When there are scandals such as the VW with scientifically sophisticated deceit of the population and governments, or ample fraud in corporations such as Enron, HSBC, Barclays, Goldman & Sachs, GSK and the Big Pharma in general, as well as initiatives of planetary impact such as the battle of Halliburton to stimulate the invasion of Iraq, not to mention the decades of struggle of the tobacco groups to deny the relationship with cancer – here the list reaches virtually all the large corporate groups – of course we wonder how decisions are taken. Why are we unable to control the widespread use of antibiotics as fattening accelerators in the meat chain, even though the multiplication of resistant bacteria and other digestive disorders is proven and is having world-wide impact?

In an article entitled “Corporate America is finding it to be increasingly difficult to stay on the right side of the law,” The Economist mentions the existence of 2,163 corporate convictions since 2000, and that “the number of convictions and the size of fines has grown impressively during the period “, within the ambit of federal prosecutions alone. (The Economist, August 30, 2014). A report by US senator Elizabeth Warren presents 20 show-cases of corporate fraud and the fragility of governments to control them. (Warren, 2016)

Of major interest in the Lumsdaine research is that it focuses more on administrative and control complexity of what is happening, rather than on size. The authors point out that, under the Basel II, Basel III regulatory framework and the Dodd-Frank law, “in general terms, however, the size is usually considered in financial terms (e.g. dollars), more than in terms of organizational structure traits.” According to the authors, although the corporation’s size is clearly important, this standpoint is insufficient. “Despite the ease of implementation, a size-based threshold is in many ways unsatisfactory, precisely because it does not take into account the level of complexity of a firm’s business activities.” (Lumsdaine, 15)

The approach in this research allows a reasonable quantification of the complexity of a corporation that operates in many countries, in many sectors of activity, with thousands of scattered business units, with an increasing number of hierarchical levels, and in numerous and complex differentiated legal frameworks.

Below is the list of analyzed companies. Those belonging to the group of 29 systemically important financial institutions (SIFIs) are marked with an asterisk. Some companies, not analyzed in the research, were included by the authors to maintain the full list:

Banks and Insurance Companies

*Bank of America (US) Allianz (DE)

*Citigroup (US) Aviva (GB)

*Goldman Sachs (US) Axa (FR)

*JP Morgan Chase (US) Swiss Re (CH)

*Morgan Stanley (US) Zurich (CH)

Royal Bank of Canada (CA)

*Barclays PLC (GB)

*HSBC Holdings PLC (GB)

*Royal Bank of Scotland PLC (GB)

Standard Chartered (GB)

*Credit Suisse AG (CH)

*UBS AG (CH)

*BNP Paribas SA (FR)

*Société Générale SA (FR)

BBVA (ES)

*Banco Santander SA (ES)

*Mitsubishi UFJ FG (JP)

*Mizuho FG (JP)

Nomura (JP)

*Sumitomo Mitsui FG (JP)

Banca Intesa (IT)

*UniCredit (IT)*

*Deutsche Bank AG (DE)

*ING Groep NV (NL)

SIFIs not included in the dataset:

[Wells Fargo (US) *] [Lloyds (GB)*] [Banque Populaire (FR)*] [Crédit Agricole (FR)*] [Commerzbank (DE)*] [Dexia (BE) *] [Bank of China (CN)*] [Nordea (SW) *]

The corporate gigantism therefore generates a disturbing internal inefficiency, which largely explains that they are all paying huge fines on sentences ranging from human rights abuse to systemic fraud in the financial sector and outright trickery of customers. With the Libor and similar rigging schemes we are reaching major macroeconomic impacts.

The basic fact is beyond a given number of hierarchical levels and organizational complexity, top management believes that at the bottom of the pyramid instructions are carried out, while at the bottom, in a firm effectively producing some goods or services, local managers believe that way on the top they know what really is taking place. Once again, financial results are the only common denominator.

On the other hand, there is a very extensive process of disclaimer or dilution of accountability. Gigantism is such that no one ever really knows who was responsible for a corporate crime. When Brazil enacted that fruit juices must have a minimum of 15% of “fruit juice”, companies continued to maintain the ridiculous level of fruit and renamed the cartons as “nectar”, a term which is not legally categorized. But to seek the responsibilities would lead whoever complains to successive complex levels of ownership and control of the company, reaching the top, in some distant country, where the company’s lawyers will say that they are not allowed to disclose names due to professional confidentiality. We are not talking here only in terms of the unfortunate client who will be listening to “your call is very important to us” on the phone, but of government audit bodies or specialized NGOs. The above mentioned report by Elizabeth Warren is well documented in this aspect. Accountability is dramatically reduced or inexistant.

The main factor of systemic deformation of corporate giants has much to do with hierarchy filters. Managers at the top of the pyramid, those in charge of thousands of companies in various sectors of activity and in different countries, simply start to reduce goals to a single criterion, financial results. Not only because this is the prevailing logic of the company, but because it is the only flow they can measure and pocket. Thereby the expected profitability is imposed on a distant branch, submitted to a fifth or sixth level of financial holdings, and the rest does not matter much, unless a scandalous breach of law or ethics becomes public.

Compensation criteria and the bonus of several distant or intermediate boards follow directly this criterion, which verticalizes maximization of financial results, from top to bottom of the pyramid, creating a process at the same time coherent and absurd. The Bank of Brazil, for example, had an important initiative for Sustainable Regional Development. However, the objective of credit managers at the front desk continued to follow the line of maximizing uptake and minimizing risks, and none of them would put their bonus on the line even if they saw credit support for small business initiatives in their municipality as worthy. The main objective overshadows the others. The systemic logic of the whole decision process would have to be changed.

When all is said and done, and financial institutions are at the top, the rest finally, financial result is what matters. When a Volkswagen generates the absurdities that we saw concerning CO2 emissions, with conscious large-scale fraud during years, it certainly made news. The issue is not only fraud, but that it comprises common and current practices by well-paid people with higher education, who understand perfectly the fraud they practice, and create ethical screens to sleep peacefully. We are facing illegal activities internally discussed and accepted by the corporate governing bodies. Many do sense the contradictions, yet find themselves powerless within the system.

There is a gap to breach in terms of research on corporate governance, that the Lumsdaine study does not cover, namely the internal balances of power between the technical sphere, people who understand the real product that will reach the consumer, and the business sphere. In practice, those who end up ruling the corporations are in the finance department, supported by the powerful legal department – real internal ministry – and the marketing department that takes care of the image. Ignored, and this is essential, is the criterion of corporate contribution or costs to environment and society.

An example may help. Among many others, we can pick out the widely studied GSK. This is the sixth pharmaceutical group in the world, and it is paying $ 3 billion in fines for fraud on various types on medical drugs. It is a technically competent company in its proper productive dimension, it has excellent laboratories and researchers, and it is growing through acquisition of more companies worldwide. GSK sold Wellbutrin in the US, a powerful antidepressant, as if it were a slimming pill, which is criminal, it sold Avandia hiding the results of their own research that showed increased heart risks, or Paxil, an antidepressant given to young people with suicidal tendencies, which as a matter of fact, did not act more than any placebo, with disastrous effects. Sentence of the company was due to charges made by four technicians, as they were aware of the absurdity of what was being done. (Time, 2012)

But of particular interest for us is that a company specialized in health sustains a massive fraud on various products and that this fraud continued for years with successive administrations. In this case, after conviction and outraged manifestations of deceived users, the company’s shares rose, contrary to what would be expected if the company was judged for its contributions to health. GSK showed that with frauds it reached incomparably higher profits than the costs of the litigation settlement, in 2012. Large institutional investors, the giants of finance who hold the bulk of the shares reacted positively, for they had financial gains in the process. In other words, the financial power at the top imposes its profitability criteria on the group, criteria that are replicated at the various levels of the corporate pyramid.

In advertising, what we will see are pictures of laboratories with white-coated technicians, if not a mother with a baby in her arms, with a message of safety and security. And since advertising is the life of media, which adapts and scantly informs, the circle closes. On the side of justice, the currently widespread practice is that those responsible do not need to acknowledge guilt, it is the so-called settlement, a legal agreement, in this case of $ 3 billion. In 2015, a new president was appointed, incidentally the former chairman of scandalous Royal Bank of Scotland. He knows nothing about pharmacy, nor needs to, that is not the issue. His specialty is finance.

On the other hand, with the stranglehold of institutional investors over end-producers of goods and services, financial results become mandatory. They prevent initiatives at the level of technicians who know the processes of the real economy, to preserve a minimum of professional decency and corporate ethics. So we have chaos in terms of consistency with the interests of economic and social development, but a very targeted and logical system when it comes to ensuring a greater flow of financial resources to the top of the hierarchy.

The financial systemic oligopoly

François Morin, a former adviser to the Banque de France, author of a dozen books on the organization of financial systems, really understands the subject. He wrote a small book, outstanding in terms of describing how the oligopoly of these financial giants operates on the planet. Extremely clear and didactic, with simple tables, he explains the mechanisms of power used by the groups. While the research by Lumsdaine (and others) analyzed above highlights gigantism and the problem of internal articulation of these strange and new financial creatures, who control thousands of companies from different fields and scattered around the world – new of course, by the scale and by instant electronic connectivity – Morin’s analysis highlights the organization of the inter-company system, that is, how they relate.

“Actors who have acquired global dimension, into the 1990s these banks have turned into an oligopoly, because of the dominant positions they held in the largest monetary and financial markets. This oligopoly, then, turned into a ‘systemic oligopoly’ when, as from 2005, banks it comprises abused their dominant positions, multiplying fraudulent agreements. As such, is it surprising that in these circumstances, when faced by this systemic oligopoly, so new and so powerful, the States have found themselves exceeded or even have become hostages? “(Morin, 115)

With years of mergers and acquisitions, of course any informed person could already suspect of evolution towards systemic oligopolies in several areas. Noteworthy here is that details of the gears become visible. And once the workings are understood, more people in the world are becoming aware of this system’s dysfunctionality. It thrives on general instability and sapping of resources from the real economy to the speculative domain. It is a system which simultaneously causes the instability that affects us all, and provides political control instruments that prevent any serious form of regulation. Instability is their natural habitat.

All the big groups show similar fraudulent activities: JPMorgan Chase, Bank of America, Citigroup, HSBC, Deutsche Bank, Santander, Goldman Sachs and others, with a balance sheet of more than 50 trillion dollars in 2012, when world GDP is 70.8 trillion. Relations with the States are particularly interesting, because the world public debt of 49 trillion is on a par with revenues of the 28 financial groups that Morin analyzes, also in the order of 50 trillion. Due to the public debt with private giants, the States became hostages and unable to regulate the financial system in the interests of society. (Morin, 36) “In view of the States weakened by debt, the power of the large private banking players seems outrageous, particularly when taking into account that the latter are, in essence, the origin of the financial crisis, therefore, mainly of the current excessive indebtedness of States. ”

| Les Êtats face à I’oligopole systémique: Ia rupture provoquée par Ia crise de 2007-2008 (en milliers de milliards de dollars) | ||||||

| 2003 | 2005 | 2007 | 2009 | 2011 | 2013 | |

| PIB mondial | 37,8 | 46,0 | 56,2 | 58,4 | 70,8 | 73,5 |

| Dette publique mondiale | 23,6 | 26,4 | 30,0 | 37,5 | 46,3 | 51,8 |

| Produits derivés des banquessystémiques | 197,2 | 297,7 | 595,3 | 603,9 | 647,8 | 710,2 |

| Source: Banque mondiale, BIS Quarterly Review et The Economist | ||||||

The 28 also control the so-called derivatives, essentially speculation in future market variations: the volume achieved in 2013 was 710.2 trillion dollars, 10 times the world GDP. If we believe that so many countries agreed to reduce public investments and social policies, including Brazil, just to meet requirements of this small financial club, we cannot fail to see the political dimension taken by the system.

An especially strong aspect of Morin’s study is the analysis of how, since 1995, this group of banks will endow itself with instruments of joint governance, the GFMA (Global Financial Markets Association), the IIF (Institute of International Finance), the ISDA (International Swaps and Derivatives Association), the AFME (Association for Financial Markets in Europe) and the CLS Bank (Continuous Linked Settlement System Bank). The IIF, for example, “true thinking head of global finance and the major international banks,” now constitutes a political power: “The President of the IIF has an officially recognized status, which enables him to speak on behalf of big banks. We could say that the IIF is the parliament of banks; its president almost holds the role of head of state. He belongs to the great global decision makers. “(Morin, 61)

Interconnections between the systemic banks: Institutional ties ( October 20, 2014)

Presence at board of directors (BD)

| GFMA | IIF | ISDA | AFME | CLS Bank | |

| Barclays | X | X | X | X | X |

| BNP Paribas | X | X | X | X* | X |

| Citigroup | X | X | X | X | X |

| Crédit Suisse | X | X | X | X | X |

| Deutsche Bank | X | X | X | X | X |

| Goldman Sachs | X | X | X | X | X |

| HSBC | X | X* | X | X | X |

| JPMorgan Chase | X* | X | X | X | X |

| Société Générale | X | X | X* | X | X |

| UBS | X | X | X | X | X |

| UniCredit | X | X | X | X | X |

| Bank of America | X | X | X | X | |

| Bank of New York Mellon | X | X | X | ||

| Mitsubishi UFJ FG | X | X | X | ||

| Mizuho Bank Ltd | X | X | X | ||

| Morgan Stanley | X | X | X | ||

| Royal Bank of Scotland | X | X | X | ||

| Standard Chartered | X | X | X | ||

| Bank of China | X | X | |||

| BBVA | X | X | |||

| Crédit Agricole | X | X | X | ||

| Nordea | X | X | |||

| State Street | |||||

| ING | X | ||||

| Well Fargo | X | ||||

| Sumitomo Mitsui | |||||

| Number of seats at BD | 22 | 18 | 17 | 17 | 15 |

| Other banks | 8 | 16 | 5 | 5 | 9 |

| Overall total of seats at BD | 30 | 34 | 22 | 22 | 24 |

* President of the board of directors

GFMA Global Financial Markets Association.

IIF: Institute of International Finance.

ISDA: International Swaps and Derivatives Association.

AFME: Association for Financial Markets in Europe.

CLS Bank: Continuous Linked Settlement Bank System.

The table above, in a vertical reading, shows how the systemic banks are present, as legal entities, on the board of directors of each of the five institutions in the sector. The horizontal reading shows how certain institutions, the larger ones, are more interconnected than the others. China appears with the Bank of China, but on the whole most of them are Western banks, with strong North-American dominance, and a marked presence of major European countries. Here, the overall trend is quite explicit: the global financial giants are endowing themselves with political control instruments. The volumes of resources are, as a whole, higher than those managed by the public systems. And today, they also control the bulk of the media, and thus public opinion. Funding elections give them huge leverage power on political decisions. And increasingly, they penetrate the spaces opened to them by the judiciary, which we would expect to be the last bastion of safeguard of equality before the law.

Tax havens

As such, the planetary financial giants are organizing themselves, seeking essentially to transform their financial power into organized political power. This new architecture of power relies crucially on the authentic legal vacuum in which they move: jurisdictions and central banks pertain to the national spheres, while the financial systemic oligopoly moves in a planetary space, with sound domestic roots, particularly in the USA and in the UK, yet with an effective extraterritoriality opened by the network of tax havens, the subject of an excellent analysis by Nicholas Shaxson in what Jeffrey Sachs describes as “an utterly superb book”.

We are used to read critics against tax havens, but the truth is that only very recently we became aware of the central role they play in the global economy, to the extent that these are not “islands” in the economic sense, but a systemic network of territories, that are beyond national jurisdictions. Major financial institutions, by funneling financial flows through territories where control is interrupted, partly or totally elude their tax obligations, hide the sources of funds, or disguise their destination.

All major global financial groups and the largest economic groups in general have branches (or headquarters) in tax havens. Tax havens do not comprise only a territory, but a dimension of virtually all economic activities of the corporate giants, forming a kind of global clearing house, where the various financial flows enter the secret area, zero tax or equivalent, frustrating any national follow up attempt. The funds will be converted to various uses, passed on to companies with different names and nationalities, and formally washed clean, exempt from any sin. There is not one secret space, but indeed, with the fragmentation of financial flows, which resurface elsewhere and with other names, it is the whole of the system that becomes opaque: “If you cannot see the whole, you cannot understand it. The activity does not take place in some jurisdiction – it takes place between jurisdictions. The ‘elsewhere’ became ‘nowhere’: a world without rules.” (Shaxson, 28)

The dimension of theses flows has become more evident since the 2008 crisis, in part as a result of successive meetings of the G20. Major investigation initiatives were taken up by TJN (Tax Justice Network), GFI (Global Financial Integrity), ICIJ (International Consortium of Investigative Journalists), and the Economist itself. The orders of magnitude is that there are around 21-32 trillion in tax havens, as compared to a world GDP of 73 trillion (2012). Brazil participates with something like $ 520 billion, around 30% of GDP.

An important step towards an improvement of the financial environment is the OECD sponsored BEPS (Base Erosion and Profit Shifting) agreement in 2015, but it is still a long way to the creation of a legal framework to restrain the planetary financial chaos. At the bottom, there is a central issue: the financial system is planetary, whereas laws are national, and there is no world government. The political weight of financial giants is sufficient to bend the regulatory attempts by specific governments.

The system directly impacts the production processes: “Keynes understood the basic tension between democracy and free capital flows. If a country trying to reduce interest rates, say, to stimulate local industries in difficulty, it is likely that capital will fly abroad in search of higher remuneration, thwarting the purpose.”(Shaxson, 56) When furthermore one can earn more by investing in financial products, and stop paying taxes, any economic policy at the national level becomes unrealistic. Thus, “the offshore system has grown with metastases around the globe, and a powerful army of lawyers, accountants and bankers emerged to make the system operate… Indeed, the system rarely added some value, but rather was redistributing wealth upward and risks downward, and creating a new global greenhouse for crime.” (Shaxson, 130) Connection to the global financial crisis is direct: “It is no coincidence that so many of those involved in financial tricks, as Enron or the fraudulent empire of Bernie Madoff, or Stanford Bank of Sir Allen Stanford, or Lehman Brothers or AIG, were so deeply entrenched in offshore.” (Shaxson, 218)

Very significant is the fact that illegality surfaces not through adequate management and regulation systems, but through leaks, like the Panama papers analyzed by the International Consortium of Investigative Journalists (ICIJ): “The documents make it clear that major banks are big drivers behind the creation of hard-to-trace companies in the British Virgin Islands, Panama and other offshore havens. The files list nearly 15,600 paper companies that banks set up for clients who want keep their finances under wraps, including thousands created by international giants UBS and HSBC.” (ICIJ, 2016)

Overall, the fact that investing in financial speculation brings higher yields than investing in productive activities tends to dry up access to cheap credit that could result in economic growth. When these financial flows are simultaneously allowed to avoid taxes, reducing the capacity of public investment in infrastructure and social policies, both private and public capacity of stimulating growth are hampered. Add to this the resources drained from our taxes through public debt, and the stronghold is complete. The so-called austerity measures basically constitute a drain on the income of the population to cover the gaps. This reduces the demand side of the economic turnover. There is no way of balancing economic development with these drains combined. And it is no surprise that 62 billionaires have more accumulated wealth than the 3.6 billion poorer inhabitants of this planet. The system is badly flawed, it is simply not functional.

Appropriation of the legal system

Most of the activities are legal. Grand corruption, as presented elsewhere (L. Dowbor, Os estranhos caminhos do nosso dinheiro, 2014), generates its own legality, which involves appropriation of the policy process that Shaxson describes as “State capture”: It is not illegal to have an account in the Cayman Islands, where the legality and secrecy are complete: it is “a place that seeks to attract money by offering politically stable facilities to help persons or entities, to circumvent rules, laws and regulations of other jurisdictions” (Shaxson. , 228)

It is largely a matter of systemic corruption: “In essence, corruption involves insiders who abuse of the common good, in secrecy and with impunity, undermining the rules and systems that promote public interest, and undermining our reliance on these rules and systems. This process exacerbates poverty and inequality and entrenches interests involved and a power that is not accountable. “(Shaxson, 229)

In the original concept of corporations, anonymity of ownership and the right to be treated as legal entities, that they may declare their registered seat where they want and not restricted to the effective location of their activities, was supposed to be balanced by transparency of accounts. “Originally, corporations had to meet a number of obligations with the societies in which they were located, and in particular to be transparent in their business and pay taxes….The tax is not a cost for shareholders, to be minimized, but a distribution to stakeholders of the company: a return on investment that societies and their governments have made in infrastructure, education, security and other basic requirements of any corporate activity.”(Shaxson, 228)

In this study, Shaxson did not produce a pamphlet against tax havens, but dismantled the mechanisms of international finance that rely on them, offering us a tool to understand the world chaos that leaves us increasingly perplexed. The mechanism affects us all, in the regressive impact of the tax burden, but also in everyday economic transactions: “The construction of secret monopolies through offshore opacity seems to penetrate extensively in certain sectors and helps to explain why, for example, the bills of mobile phones are so high in some developing countries. ” (Shaxson, 148) The impacts are systemic, “Bribes contaminate and corrupt governments, and tax havens contaminate and corrupt the global financial system” (Shaxson, 229).

The truth is that a system precluding all legal and penal control of the banking crime was created. Practically, all major groups have dozens of convictions for the most diverse frauds, but there were, virtually, no legal consequences, such as personal conviction of those responsible. The system created involves a fine, court settlement that exempts the corporation upon payment from formal declaration of guilt. While breaking the law the company just has to make a financial provision to meet the likely costs of court settlements. To name a few cases, Deutsche Bank is paying a fine of $ 2.6 billion in 2015, Crédit Suisse is paying 2.5 billion for conviction, in 2014 and so on, involving all the corporate giants. An exercise of systematization of financial criminality can be found in “Corporate Research Project”, which presents the convictions and agreements grouped by company.

Generally , when ordered to pay fines (without avowal of guilt), corporations set up a big show, changing some heads at the top of the corporation, with the inevitable announcement that there were errors, but that the company is healthy, and that distortions will be redressed. Those responsible, not only come out free, but are also provided with the legally applicable bonus, since no guilt was confessed. Confronting the huge wave of corporate fraud with the marketing messages destined to attract young people to a promising career with high ethical values ??and economic vitality is a depressing but instructive exercise. (BBC, 2015) US senator Elizabeth Warren presents 20 examples of large scale fraud with important social and environmental critical results that were recently resolved with fines out of proportion with the damage caused. Her report is adequately named Rigged Justice: 2016 – How weak enforcement lets corporate offender off easy.

The legal dimension is evolving, since corporations are forming a parallel judiciary enabling them to sue the States. International corporations are radically expanding their legal instruments of political power. In the words of Luis Parada, a lawyer of governments in dispute with global private groups, “the issue ultimately is whether a foreign investor can force a government to change its laws to please the investor, rather than the investor to fit to the laws existing in the country.”

Today, corporations have their own legal apparatus, such as the International Centre for the Settlement of Investment Disputes (ICSID) and similar institutions in London, Paris, Hong Kong and others. Typically, they will attack a country because it sets forth environmental or social rules that they deem unfavorable, and sue for profits they might have had. The extensive article published in The Guardian (Provost, 2015) presents this new field of international relations that is expanding and transforming the rules of the game. The authors qualify this trend as “an obscure but increasingly powerful field of international law”.

Although, not suited herein, the legal dispute is an essential dimension of TTIP proposals (Transatlantic Trade and Investment Partnership) in the sphere of the Atlantic and TPP (Trans-Pacific Partnership) in the sphere of the Pacific, when coercing a set of countries to follow transnational rules, where national states will lose the capability to regulate environmental, social and economic issues, and particularly, the corporations themselves.

The crisis of accountability

Who is responsible? The search for culprits basically does not help when the issue is overall corporate culture, when any executive is simply led to behave like the others, since the problem is systemic, of corporate governance. Once we reach corporate elephantiasis, it is hard to avoid an overall dilution of responsibilities, for the ground is no longer suitable for any behavior that is not just opportunistic. One must remember that in this context we have successive strata of lawyers, accountants, marketers and consultants whose regular income and bonuses depend directly and solely on financial results. In addition, the general opacity brought about by financial flows crossing the invisibility tunnel in tax havens, where they are scrambled and made unrecognizable, frustrates any attempt of public control. We have created fertile ground for widespread deviations.

There is at present a wide gap between a firm at the bottom of the pyramid which actually produces food, for example, and the various levels of holding companies to which it belongs, besides institutional investors such as pension funds and others. At the top or even intermediate levels, managers do not care very much whether or not there are pesticides in the products sold, since they only follow the performance of the mix of shares of their investment portfolio. The continuous struggle of health organizations to stop antibiotics being used to stimulate growth in animal farming, even though the growth of resistant bacteria is well known, illustrates this divorce between social necessities and corporate decision process. With such a degree of concentration, hierarchization, bureaucracy and gigantism, the so-called “systemically significant” economic groups are simply unmanageable, stumbling from one legal trouble to another, from crisis to crisis, with this only common denominator of rationality, maximizing financial results.

This breakup of the chain of accountability deeply changes the business world. Whereas in a traditional small or medium sized company it was simple to know who is responsible, today regulators face a legal department, that is to say, after facing the public relations department. And criminal solidarity permeates the whole corporate culture. How can we forget the triple A investment grade which was bestowed upon Enron, Lehman Brothers and scores of other big names? Everything is fluid, they are huge and hungry mollusks where any argument penetrates endless intricacies and gets lost into the smiles of managers who say it is not their fault. Indeed it is not, because accountability is diluted in the circumvolutions of a shapeless lump where only money instinctively knows it has to trickle up.

An important factor of the accountability crisis is the closed information environments these corporations have built around themselves. They certainly are present in the big media through marketing campaigns, but it mainly serves the objective of creating a positive image of the corporation. At the same time any attempt at giving publicity to what is really happening in the firm is forbidden. Ex-employees had to sign a silence contract, eventual whistleblowers are prosecuted even if they show dramatic consequences for consumers or the environment. The justification is to protect technological secrets of the corporation, but in fact it creates a closed unhealthy environment which thwarts any attempt at governance improvement. The population and clients only discover a sea of fraud, illegality and mismanagement when the corporation breaks down. There is no possibility to really improve corporate governance without transparency, and permanent accountability.

The basic principle that made the system work was competition. In a way, a company had to win consumer confidence by meeting real needs, and the result would be healthy competition and better service. At the level of corporate giants, agreements are more profitable than wars, and when there is war, it is to impose a single standard, of the winner, and to enhance the size of the oligopoly. The financial system, which today drains the economy instead of serving it, is a good example of systemic deformation of the corporate world we have to face.

Whatever the tensions and wars between corporations, to conquer markets or dominate technologies for example, when it comes to protecting profit, to maintain the opacity, to reduce or cancel taxes on financial profits, or to regulate tax havens, large corporations react as one body, through the institutions and representations shown above. And in this case, the fragmented public institutions simply do not have enough weight to face the onslaught, no matter how disastrous it is for the development of the country and the people. Giants who generate chaos in their activities, but come together and bare their teeth when threatened in their privileges – corporations – simply created a new political reality. We are increasingly closer to what David Korten formulated so clearly in his now classic study, When Corporations Rule the World.

References

Aron, Jacob – Capitalism’s hidden web of power – New Scientist, May 23, 2015 file:///C:/Users/Ladislau%20Dowbor/Downloads/Unravelling%20capitalism’s%20hidden%20networks%20of%20power%20_%20New%20Scientist.pdf

BBC – Deutsche Bank Reveals Radical Restructuring Plan – October 19, 2015 – http://www.bbc.com/news/business-34567868?ocid=global_bbccom_email_19102015_business

Corporate Research Project – Corporate Rap Sheet – http://www.corp-research.org/credit-suisse (databank of corporate criminality)

Dowbor, Ladislau – Resgatando o potencial do sistema financeiro no país – October, 2015, 39p. – http://dowbor.org/2015/10/ladislau-dowbor-resgatando-o-potencial-financeiro-do-pais-31p-junho-2015-texto-provisorio-em-construcao-ampliacao-do-artigo-sobre-o-sistema-financeiro-julho-2015-31p.html/

Dowbor, Ladislau – Os estranhos caminhos do nosso dinheiro – Fundação Perseu Abramo, São Paulo, 2015 – http://dowbor.org/blog/wp-content/uploads/2012/06/13-Descaminhos-do-dinheiro-público-16-julho.doc

Dowbor, Ladislau – Economic Democracy: a Brazilian perspective – Lambert Academic Publishing, Saarbrücken, 2014

Dowbor, Ladislau – Producers, intermediaries and consumers – 2014 http://dowbor.org/2014/02/ladislau-dowbor-producers-intermediaries-and-consumers-the-price-chain-approach-fevereiro-2014-15p.html/

Economist – Giants of global finance are in trouble – The Economist, March 7th 2015 http://www.economist.com/news/finance-and-economics/21645807-giants-global-finance-are-trouble-world-pain

GPF – Global Policy Forum – Fit for whose purpose? – New York, September, 2015 https://www.globalpolicy.org/images/pdfs/images/pdfs/Fit_for_whose_purpose_online.pdf

Henry, James – The Price of off-shore revisited – Tax Justice Network, http://www.taxjustice.net/2014/01/17/price-offshore-revisited/

ICIJ – Panama Papers: Global Overview – 2016 – https://panamapapers.icij.org/20160403-panama-papers-global-overview.html

Korten, David – when corporations rule the world – Berrett-Koehler Publishers, San Francisco, 1995

Lumsdaine, R. L., D.N. Rockmore, N. Foti, G. Leibon, J.D. Farmer – The Intrafirm Complexity of Systemically Important Financial Institutions – 8 May, 2015 – whole article available in http://arxiv.org/ftp/arxiv/papers/1505/1505.02305.pdf

Mattera, Philip – Crédit Suisse: Corporate Rap Sheet – CRP (Corporate Research Project) – http://www.corp-research.org/credit-suisse

Morin, François – L’hydre mondiale: L’oligopole bancaire – Lux Editeur, Québec, 2015, 165p. – ISBN 978-2-89596-199-4 – http://dowbor.org/2015/09/francoismorin-lhydre-mondiale-loligopole-bancaire-lux-editeur-quebec-2015-165p-isbn-978-2-89596-199-4.html/

Perkins, John – Confessions of an economic hitman – Berrett-Koehler, San Francisco, 2004, http://dowbor.org/2005/01/confessions-of-an-economic-hit-man-confissoes-de-um-agressor-economico-250-p.html/

Provost, Claire and Matt Kennard – The obscure legal system that lets corporations sue countries – The Guardian, June 2015 http://www.theguardian.com/business/2015/jun/10/obscure-legal-system-lets-corporations-sue-states-ttip-icsid#_=_in Portuguese http://cartamaior.com.br/?/Especial/O-golpe-fiscal-e-o-impeachment-do-Brasil/Assim-funcionam-as-cortes-de-excecao-do-capital/209/34806

Ruggie, John Gerard – Just Business: multinational corporations and human rights – Norton, New York, 2013 – http://dowbor.org/2013/10/john-gerard-ruggie-just-business-multinational-corporations-and-human-rights-w-w-norton-new-york-ouctober-2013-3p.html/

Schneyer, Joshua – Commodity Traders: the Trillion Dollars Club – http://dowbor.org/2014/02/ladislau-dowbor-producers-intermediaries-and-consumers-the-price-chain-approach-fevereiro-2014-15p.html/

Shaxson, Nicholas – Treasure Islands: uncovering the damage of offshore banking and tax havens – St. Martin’s Press, New York, 2011 – http://dowbor.org/2015/10/nicholas-shaxson-treasure-islands-uncovering-the-damage-of-offshore-banking-and-tax-havens-st-martins-press-new-york-2011.html/

Time Magazine – Alexandra Sifferlin – Breaking down GlaxoSmithKline’s billion dollar wrongdoing – July 5, 2012, http://healthland.time.com/2012/07/05/breaking-down-glaxosmithklines-billion-dollar-wrongdoing/ The Wikipedia in English has a fully updated coverage on the recent evolution of GSK.

Valor – Grandes Grupos: 200 maiores com organogramas e participações acionárias – São Paulo, December, 2014

Vitali,S., J.B Glattfelder and S. Battiston – The Network of Global Corporate Control – Chair of Systems Design, ETH Zurich – corresponding author sbattiston@ethz.ch ; http://j-node.blogspot.com/2011/10/network-of-global-corporate-control.html ; ver resenha em http://dowbor.org/2012/02/a-rede-do-poder-corporativo-mundial-7.html/

Warren, Elizabeth – Rigged Justice – Jan. 2016, 16 p. http://www.warren.senate.gov/files/documents/Rigged_Justice_2016.pdf and New York Times 29/01/2016 http://www.nytimes.com/2016/01/29/opinion/elizabeth-warren-one-way-to-rebuild-our-institutions.html?_r=0

[1] Ladislau Dowbor, PhD in Economics, professor at the Catholic University of São Paulo, works with numerous government and non-profit institutions, and with different agencies of the United Nations. He is the author of more than 40 books and of a number of technical studies in the area of development planning. His publications are posted in full text on the http://dowbor.org web-site, free for non-commercial use (Creative Commons).