Renewable Energy’s Potential May Be Understated

Utilities look at batteries, software and new pricing strategies to prevent overloads from wind and solar power

California’s grid so far has been able to manage large but fluctuating power flows from wind and solar sources. Photo: Konrad Fiedler/Bloomberg News

By Gabriel Kahn

In February 2013, California energy officials sat down with power-industry executives to figure out how to avert an approaching calamity: The rapid rollout of wind and solar electricity was stressing the state’s grid. The more renewable energy California added, the more its power supply could be whipsawed by a cloudy day or a windy storm. Some at the meeting warned that problems, such as rolling brownouts, could start to show up later that year.

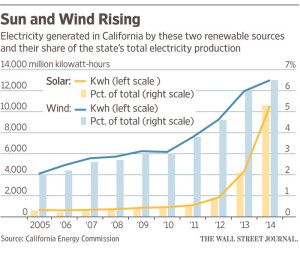

Those same worries were being echoed from Hawaii to Florida, as authorities struggled to load aging electricity grids with ever-greater amounts of renewable power. At the time, renewable energy accounted for about 14% of California’s electricity output.

Today, California often gets as much as 30% of its power from renewables; there are periods of the day when production can soar to 40%. California legislators just approved a plan that would require half of all power to come from renewables by 2030. Still, the tipping point the power industry feared hasn’t materialized.

Journal Report

- Insights from The Experts

- Read more at WSJ.com/EnergyReport

More in Energy

- How to Transport Oil More Safely

- Low Oil Prices Spur Innovation

- Community Solar Power May Take Off

- Zombie Servers Suck Up Energy

- The Solar Solution in Africa

The experience of California and other states with high concentrations of solar and wind, such as Hawaii, is challenging long-held assumptions about the limits of renewable energy. As the boundary of what is considered possible expands, so does the momentum around investment in new technology and resources.

“You’ll hear numbers [that] people bandy about and most of them are wrong: ‘We know we can get to at least 35% or 40%,’ ” says Haresh Kamath, an expert in energy storage and distributed generation with the Electric Power Research Institute in Palo Alto, Calif. “Now that we’re getting to those numbers, people are pushing them up again.”

Plenty of risks still remain. But the fact that the grid has been able to handle more renewables than previously thought is driving massive changes through the industry. One of the places it is being felt most acutely is among utilities.

Rooftop sourcing

Ted Craver is the chief executive of Edison International Inc., parent of Southern California Edison, one of the nation’s largest electricity retailers. A few years ago, most of his investment was devoted to procuring power from big plants and sending it across large transmission lines. Today, he’s expecting much of his new power to come from his customers’ rooftops. In the first quarter, residential solar installations across the U.S. grew by 76% over the same period a year earlier, adding 1.3 gigawatts of capacity.

“We will be lucky to see any growth in the large central plant; it will probably decline,” he says. That is altering how he spends his money. He now plans on investing about $4 billion a year for the next three years upgrading the distribution network—the wires that connect homes to the grid—to make the grid better equipped to carry power back and forth, instead of just downstream.

“We will be lucky to see any growth in the large central plant; it will probably decline,” he says. That is altering how he spends his money. He now plans on investing about $4 billion a year for the next three years upgrading the distribution network—the wires that connect homes to the grid—to make the grid better equipped to carry power back and forth, instead of just downstream.

The bigger change is how that will impact the core business of utilities, once the slumbering giants of the power industry. More solar means their once-captive customers suddenly have choice. To retain them, the utilities need to forge a stickier relationship—something that will require substantial regulatory change as well as a shift in how they run their business.

Mr. Craver, for one, says he’s looking for a way to help manage a marketplace in which some of his customers are selling the power they generate while others are buying it.

“Think Bitcoin, eHarmony, eBay—platforms that match buyer and seller on an individual basis,” says Mr. Craver. “That is the vision some of us have for the longer term.”

Morning jolts

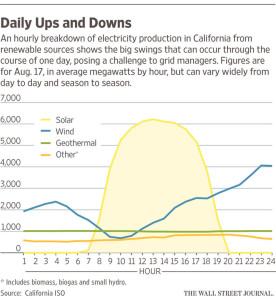

There are still moments when the grid can teeter on the brink, usually due to a series of coincidences. Most wind power in California comes at night, for example. But occasionally it keeps blowing into the morning, as the sun begins firing up solar panels. As demand is typically light then, a surge could swarm the grid with excess power—which can fry equipment and interrupt service.

To forestall such a possibility, officials at Ca-ISO, the state grid operator, are expanding the regional footprint where its renewable  power can be consumed. Its weapon to date has been something called the energy-imbalance market—a spot market where power is traded at 15-minute or even 5-minute intervals. The market now includes not just California players, but also Pacific Corp., with power assets in Oregon and other Western states. Soon, Phoenix-based Arizona Public Service will join, followed by NV Energy of Nevada.

power can be consumed. Its weapon to date has been something called the energy-imbalance market—a spot market where power is traded at 15-minute or even 5-minute intervals. The market now includes not just California players, but also Pacific Corp., with power assets in Oregon and other Western states. Soon, Phoenix-based Arizona Public Service will join, followed by NV Energy of Nevada.

The energy-imbalance market works like a relief valve to offset pressure in the system. But solar is still being added at a heady pace. That means the state is essentially in a perpetual foot race, trying to stay one step ahead of the on-again, off-again issues brought on by renewable power.

With so much solar on the grid, a sudden weather shift still can leave utilities scrambling for more power. Rushing to fill the breach is a bevy of tech companies that insist the energy industry doesn’t need better power generation, just better software.

Software and storage

Boston-based EnerNOC Inc., for one, sells software that companies use to receive warnings from utilities about possible power insufficiencies. The companies can respond by, and be compensated for, cycling off an air-conditioning unit or idling an elevator. David Brewster, EnerNOC’s president, predicts that as utilities try to manage frequent bumps in their renewable energy supply, they will adopt ever more intricate pricing plans.

“We’re going to have an evolution of rate structures,” Mr. Brewster says. That is being spurred by the continuing rollout of digital electric meters, which allow utilities to send numerous price signals to consumers throughout the day, a practice known as time-of-use metering. Utilities can raise prices if they expect a shortfall in power, or lower them if they expect a deluge.

As the adoption rate of solar continues on its tear, the size of the challenge mounts. Still, some are surprisingly sanguine about the future.

“Call me an optimist, but I believe we can transition to clean energy and lower bills,” says Peter Rive, co-founder of San Mateo, Calif.-based Solar City Inc. The big changes he sees happening aren’t at the grid level, but at the home. Key to making that transition, he says, will be installing solar panels with software and storage devices—namely batteries.

Having storage and panels, with software that regulates it all, will allow the grid to tell the home when it is facing a potential power overload and instruct it to charge up the battery. Later, when the grid needs power, it can call on the battery to deliver it.

Enphase Energy Inc., ENPH 0.65 % based in Petaluma, Calif., will soon begin selling a home-solar-power storage system. So far, it will only be available in Australia. One of the hurdles is the high cost of batteries, though they are falling rapidly.

Paul Nahi, Enphase’s chief executive, insists that installing a battery alongside solar panels won’t just improve the reliability of the grid, but increase value for homeowners.

“When you wrap all these things together, solar, batteries and software,” he says, “you start to solve a lot of these problems.”

Mr. Kahn, a former Wall Street Journal bureau chief, is a professor at the University of Southern California’s Annenberg School of Journalism. Email [email protected].