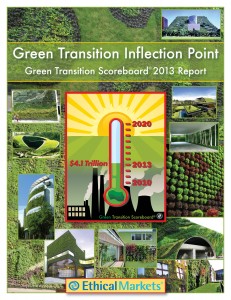

St. Augustine, FL, March 4, 2013 – The year 2013 promises long strides away from the fossil-fueled Industrial Era as illuminated by the Ethical Markets Green Transition Scoreboard® (GTS) which tracks private investments growing the green economy worldwide since 2007, finding $4.1 trillion invested or committed as of Q4 2012.

| INVESTMENTS IN GREEN: 2007-2012 | |

|

Sector |

US $ |

| Renewable Energy |

$2,281,347,792,080 |

| Green Construction |

$837,620,000,000 |

| Energy Efficiency |

$526,921,247,320 |

| Corporate R&D |

$254,800,000,000 |

| Cleantech |

$224,601,088,873 |

| TOTAL |

$4,125,290,128,273 |

The year 2012 was an inflection point for the green transition worldwide. Technology and innovation such as in electricity generation and transport began forcing structural changes and rethinking of business models, urban design and development toward integrated systemic approaches.

The Green Transition Scoreboard® tracks five sectors: Renewable Energy; Green Construction, Energy Efficiency; Corporate R&D and Cleantech, with each broad area of green technologies including substantial capital investment based on Ethical Markets president Hazel Henderson’s years of research as a science advisor and the Ethical Markets Advisory Board expertise.  Says Dr. Henderson, “the output of Rio+20 was an unprecedented reintegration of human knowledge, realizing that environmental, social and human capital must be assessed and integrated into financial markets in order to achieve equitable and sustainable forms of development and resulting in new global shared goals and paths toward low-carbon, cleaner, greener, information-richer economies.”

Says Dr. Henderson, “the output of Rio+20 was an unprecedented reintegration of human knowledge, realizing that environmental, social and human capital must be assessed and integrated into financial markets in order to achieve equitable and sustainable forms of development and resulting in new global shared goals and paths toward low-carbon, cleaner, greener, information-richer economies.”

The March 2013 GTS report “Green Transition Inflection Point” demonstrates that many private investors are following our recommended avenue for institutional investors to shift to green sectors. This transition strategy, recognized in the 2012 report by Mercer which suggests 40% of portfolios should be in Green Transition sectors, validates models indicating that investing $1 trillion annually until 2020 can scale innovations and reduce costs. With over $4.1 trillion invested since 2007, investors and countries growing green sectors globally are on track to reach $10 trillion in investments by 2020.

The GTS omits nuclear, clean coal, carbon capture & sequestration, and biofuels from feedstocks other than sea-grown algae. Fossilized sectors are becoming increasingly stranded assets as low-carbon regulations are implemented and oil, coal and gas reserves become harder to exploit. We are also looking closely at nanotech, genetic engineering, artificial life-forms and 3D printing, determining their green contribution on a case by case basis.

GTS data sources include the highly respected Cleantech, Bloomberg, Yahoo Finance, Reuters and many new UN and other international studies, NASA and individual company reports. Companies, organizations and the sources of financial data included in the GTS are screened by rigorous social, environment and ethical auditing standards.

Awareness grew in 2012 of localization as a key principle for redesigning industrial methods, agriculture, infrastructure, sustainable communities as developed by our partner company Biomimicry 3.8 and our joint Principles of Ethical Biomimicry Finance™. Green technologies and systems investments are the next evolution of human societies as we learn from earth systems sciences. Renewable Energy – Important to this rapidly expanding sector is the growth of renewable energy in developing countries. Green Construction – This is the most conservatively under-reported sector of this report. We are only counting green construction materials, not including labor. Energy Efficiency – Investments include conservation efforts and initiatives and products focused on lowering energy needs or using less energy than a comparable product, as companies now recognize efficiency investments’ rapid payback periods. Green R&D – Significant company investments show sustainability is integrated into its core strategy, serving as a strong indicator for investors. This data helps identify innovative companies ahead of the curve in responding to heightening environmental risks and regulations.

Cleantech – As Cleantech grows, energy storage increases in importance, at the level of power plants and grid electricity and at retail and local levels with improvements in batteries, fuel cells, flywheels, ultra capacitors, flow batteries, compressed air as well as metering of use at all levels.