Climate regulations could cost fossil-fuel firms trillions. Should they be worried?

By Brad Plumer, Published: October 25 at 1:17 pmE-mail the writer

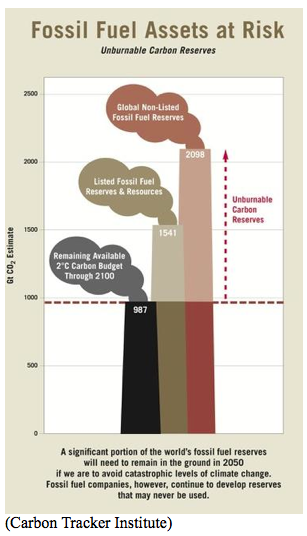

If the world ever got serious about addressing climate change, fossil-fuel companies could stand to lose billions of dollars — maybe trillions. These firms all have large reserves of oil, gas, and coal that would have to stay in the ground in order to avoid severe warming.

But how likely is this scenario? Some environmentalists have argued that regulations are inevitable — which would mean that up to 80 percent of listed fossil-fuel reserves may be “unburnable.” In an extreme case, oil, gas, and coal companies could be left with more than $6 trillion in stranded assets. This, they say, amounts to a massive “carbon bubble” set to burst.

Those skeptical of this argument counter that the financial markets are more capable of assessing the risks facing companies like ExxonMobil or Chevron than activists are. On this view, it’s unlikely there’s any sort of bubble here.

This debate is slowly attracting a wider audience. On Thursday, the managers of 70 pension funds worth more than $3 trillion wrote a letter asking 45 of the world’s top oil, gas, coal and utility companies to explain how the possibility of climate-change regulations might affect their business.

“As long-term investors, we see the world moving toward a low-carbon future in which fossil fuel reserves that companies continue to develop may actually become a liability,” said Jack Ehnes, the head of California’s State Teachers’ Retirement System, one of the pension funds involved, which has $5.4 billion invested in major fossil fuel companies.

The signatories were largely public pension funds, including the comptrollers or treasurers of California, New York City, Maryland, Oregon, and Connecticut. There were also a few smaller private firms as well, including Rockefeller & Co. The effort was organized by Ceres, a group of investors that advocates for sustainable business practices, and the Carbon Tracker Initiative.

It’s not clear how fossil-fuel companies will respond — or if they’ll even respond at all. The pension funds in question make up only a small fraction of global investment in oil, gas, and coal. And the American Petroleum Institute has already dismissed the effort, with the group’s chief economist telling Inside Climate News, “This is either delusion or wishful thinking on the part of some folks who just don’t like fossil fuels.”

Even so, the notion that there might be a $6 trillion “carbon bubble” seems to be coming up more frequently, so it’s worth dissecting.

Is there a $6 trillion carbon bubble?

Here’s the basic argument: Earlier this year, the Carbon Tracker Initiative issued a report titled “Unburnable Carbon 2013,” which calculated that the world’s publicly traded oil, gas, and coal firms would need to leave 60 to 80 percent of their reserves unused in order for the world to have a likely chance of avoiding 2°C of global warming.* In theory, that’s the goal that world leaders are aiming for.

Most fossil-fuel companies certainly don’t act as if their reserves are largely worthless. Last year, the 200 largest listed companies spent more than $674 billion on developing their oil, gas, and coal reserves — under the assumption that it will largely get burned some day. But that, argues the Carbon Tracker Initiative, is a risky assumption — these investments could get upended by stringent limits on greenhouse gases.

“If [this level of capital expenditures] continues at the same level over the next decade,” the report argues, then oil, gas, and coal companies “would see up to $6.74 trillion in wasted capital developing reserves that is likely to become unburnable.”

Some observers remain skeptical of the idea that there’s actually a $6.74 trillion carbon bubble waiting to pop. Economist Richard Tol has argued that the current valuation for fossil-fuel companies may just indicate that most investors don’t believe a meaningful cap on carbon emissions is coming anytime soon. And that judgment could well be correct.

“Bubbles only arise if the ‘market’ is misinformed,” Tol wrote in May. “The ‘market’ is by no means infallible when it comes to pricing risk, but an expectation of ‘not much climate policy any time soon’ strikes me as entirely realistic.” (Here’s a 2011 essay by Tol and Roger Pielke Jr. outlining this position at length.)

And even if carbon regulations were forthcoming in the medium-term, it’s hard to calculate exactly how much that might hurt the world’s listed fossil-fuel companies. Much would depend on how strict the carbon limits are, and what they looked like.

In most plausible scenarios, it’s hard to imagine that fossil fuels, which supply 87 percent of the world’s primary energy, would disappear overnight. “I don’t believe the market puts much if any value on reserves or unproven resources which are not due to be developed within the next ten years,” wrote energy analyst Nick Butler.

Questions about climate risks

Even so, James Leaton, the research director for the Carbon Tracker Initiative, countered that many investors weren’t even asking about these risks yet. “The valuations of these fossil-fuel companies are based on certain assumptions about reserves,” Leaton told me in an interview earlier this year. “But if you put in different assumptions, you get very different answers. We’re trying to get investors to think about those different outcomes.”

Over the past year, a few other financial analysts have started wondering whether the market might be mispricing the risk of carbon regulations or a shift to cleaner energy. In January, British bank HSBC published a report arguing that stricter emissions caps or weaker oil demand could undercut up to 60 percent of the market value of some European companies. “We believe that investors have yet to price in such a risk, perhaps because it seems so long term,” the report said.

By and large, this is a question about politics: Are world governments really going to adopt stringent policies that curtail greenhouse-gas emissions and prevent global temperatures from rising more than 2°C? Could the politics of climate change shift suddenly? Plenty of climate-policy advocates are working toward that goal. But, for now, many investors in oil, gas, and coal firms seem to be betting that this isn’t a major risk in the foreseeable future.

———

* Note that the Carbon Tracker Initiative’s numbers are roughly congruent with those in the most recent report from the Intergovernmental Panel on Climate Change (IPCC), which essentially suggested (p. 20) that humanity could only emit about one-sixth of the carbon contained in known fossil-fuel reserves for a “likely” shot at preventing global average temperatures from rising more than 2ºC over pre-industrial levels.

For on those calculations, see point #2 in this post, though note that the units are slightly different (1 trillion tons equals 1000 Gt).

Brad Plumer covers energy and environmental issues, which ends up including just about everything from climate change to agriculture to urban policy and transportation. Follow him on Twitter at @bradplumer. Email him here.