Less Volume is More Value

Less Volume is More Value

Oil majors worth more

adopting 2?C pathway

Carbon Tracker last week launched Sense & Sensitivity: Maximising Value with a 2D Portfolio.

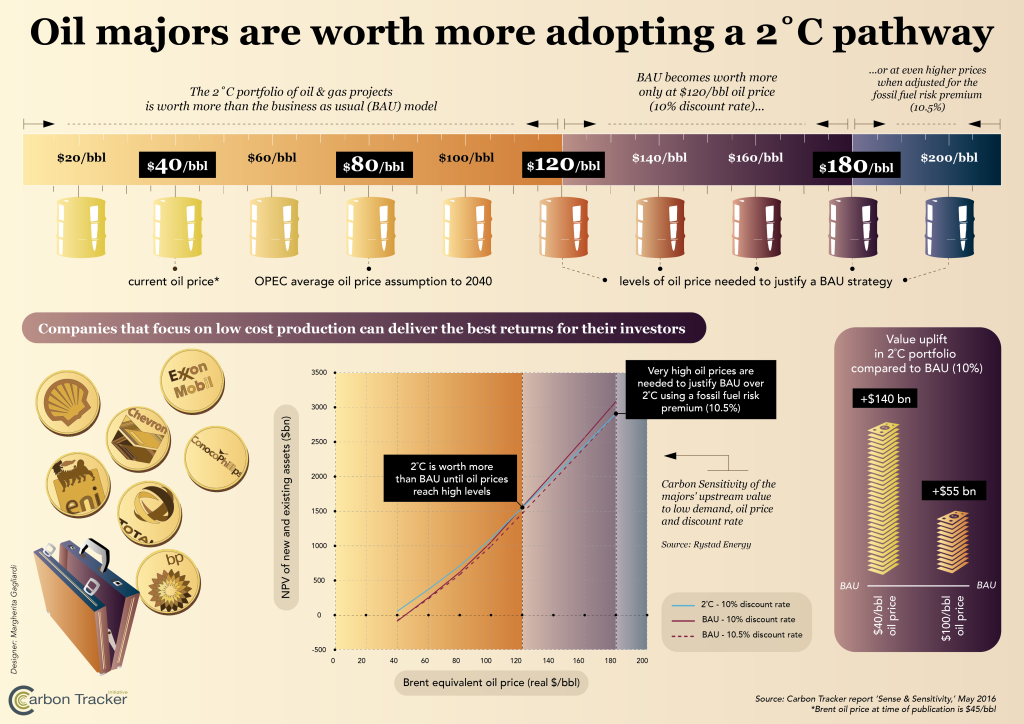

The analysis finds, somewhat surprisingly, that the world’s oil and gas majors will be worth significantly more by aligning their investment plans with a 2?C global climate target than pursuing business as usual.

Proceeding only with lower cost, less carbon-intensive projects needed to satisfy demand in a 2?C pathway could add over $100 billion to the value of the world’s seven oil majors, unless oil prices rise well beyond $100 a barrel for a sustained period of time, much higher than OPEC’s long-term average assumption of around $80 a barrel. The study is believed to be the first independent stress test to be published to date.

The study warns against repeating the mistakes of the past by gambling on high oil prices and wasting capital.

News:

Not-so-Big Oil

Not-so-Big Oil

The supermajors are being forced to rethink their business model.

Paul Spedding, Advisor to Carbon Tracker, interviewed by The Economist says: ‘If oil prices are anywhere below $120 a barrel, companies would produce higher returns if they carry out selective drilling of low-cost wells rather than “business as usual”.

7th May 2016

Oil And Gas: Change And Prosper? A New Growth Scenario In A 2° World

Oil And Gas: Change And Prosper? A New Growth Scenario In A 2° World

A study just out by the Carbon Tracker initiative has a tantalizing conclusion for the oil and gas industry. If they align their investment plans with the 2° C target on global temperatures, the upstream assets of the world’s seven largest listed oil and gas companies could collectively be worth $100 billion more

By Dina Medland, 5th May 2016

![]() Oil giants should ditch high-cost projects, thinktank says

Oil giants should ditch high-cost projects, thinktank says

“In a 2C world, the major oil and gas companies will need to manage declining demand for oil. However, this can still prove to be a value-add proposition if they simply avoid developing high-cost, high-carbon projects,” said Mark Fulton, a former Deutche Bank analyst who is now an adviser to Carbon Tracker and co?author of the new report.

By Terry Macalister, 5th May 2016

Peabody Energy seeks Chapter 11 bankruptcy protection

Peabody Energy seeks Chapter 11 bankruptcy protection

Luke Sussams, analyst at the London-based Carbon Tracker Initiative, said: “A few years ago, Peabody Energy was telling investors demand for coal was going to rise. Today it has filed for bankruptcy.

“This is a timely reminder that investors must not accept the demand expectations of fossil fuel companies on face value [and is] the most significant signal yet that the global coal market is nearing a structural decline.”

James Wilson in London and Ed Crooks, 13th April 2016

Upcoming events:

FT Energy Transformation Strategies: Beyond Fossil Fuels? Surviving and Thriving in a Post COP World

FT Energy Transformation Strategies: Beyond Fossil Fuels? Surviving and Thriving in a Post COP World

1st June 2016, London

How are oil and gas companies redefining their long-term strategy? To what extent is the debate around stranded assets dictating strategy? Anthony Hobley questions executives from the oil and gas industry as part of a C-level event organised by the FT. Register here.

![]() Responsible Investment in Europe: A multi-stakeholder conference hosted by ShareAction

Responsible Investment in Europe: A multi-stakeholder conference hosted by ShareAction

9th – 10th June 2016, Berlin

ShareAction is hosting a conference in Berlin for investment professionals, policy-makers and civil society organisations, that have an interest in accelerating Responsible Investment practice across the continent. Among a range of exciting speakers is Carbon Tracker’s CEO Anthony Hobley who will offer his views on whether investors are doing enough to shift the system towards sustainable, long-term investment. Find out more and register your free place here.

Innovation and Disruption: the energy sector in transition

Innovation and Disruption: the energy sector in transition

21st-22nd September 2016, Oxford

BIEE’s Oxford Research Conference is a biennial international research conference that seeks to understand the drivers of change in energy, both positive and negative. The conference is aimed at energy analysts, researchers, strategy and policy thinkers from all backgrounds, including industry, academia and research organisations, government, the finance community, NGOs and consultancies. Carbon Tracker’s Research Director James Leaton will discuss the potential for transformative change in the global energy system. Find the programme and register here.