Digital marketplaces rock the payments landscape — Japan relaxes fintech regulation — Fintech funding jumps

Sarah Kocianski and Jaime Toplin | March 30, 2016

Welcome to Fintech Briefing, a morning email providing the latest news, data, and insight into the developing fintech ecosystem in Europe and around the world, produced by BI Intelligence.

Did someone forward you this email? Sign up and receive Fintech Briefing to your inbox.

HELP MAKE US BETTER. When you’ve finished reading, don’t forget to rate this edition of Fintech Briefing on the scale at the bottom.

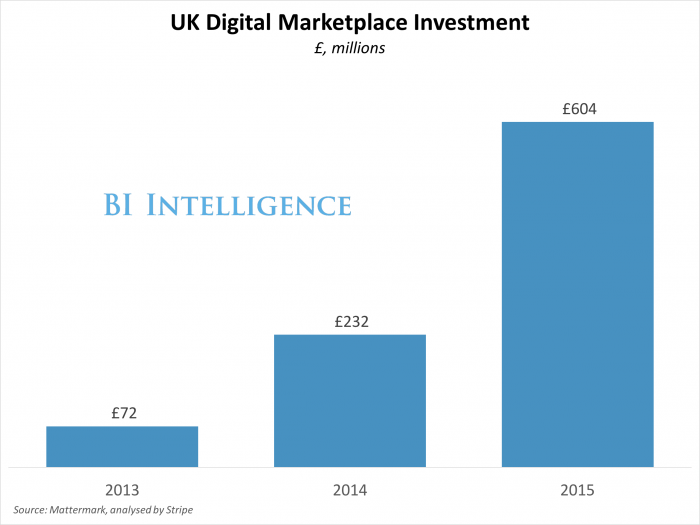

DIGITAL MARKETPLACES ARE CHANGING THE PAYMENTS LANDSCAPE: UK-based digital marketplaces are on track to raise £706 million ($1 billion) of investment this year, according to data from Mattermark, analysed by payments company Stripe. These marketplaces are platforms that bring together buyers with third party sellers, facilitating transactions rather than selling products or services themselves. Examples of UK marketplaces include P2P currency exchange TransferWise, food-ordering app Deliveroo, and holiday deals site Secret Escapes.

Digital marketplaces are here to stay because they solve a pain point. Shopping across multiple merchants is arduous. Marketplaces allow consumers to easily compare options and then make a purchase on a familiar platform without needing to go to another website to pay. This improved shopping experience is a key reason why marketplaces continue to attract funding.

Marketplaces are an opportunity for payments processors. For most firms involved in processing payments, the business is about growing purchase volume and transactions — processing fees are based on either or both. Since marketplaces aggregate purchases made across many merchants, a payments provider can dramatically increase its processing volume and market share by winning the business of just a few marketplaces. This appears to be part of Stripe’s strategy. Stripe-partnered firms account for 42% of the £609 million ($869 million) invested in UK marketplaces last year — the company is winning the business of up and coming marketplaces.

Smaller payments processors may lose out. Payments processors, particularly those that sell services on behalf of larger processors, acquire businesses one at a time via salespeople. That means acquisition cost is relatively high for a relatively small amount of volume. Processors that target verticals that are being disrupted by marketplaces will see their margins further compressed. That’s because acquisition cost will remain the same while their customers’ volume will increasingly be diverted to marketplaces and therefore competing processors.

JAPAN ENCOURAGES FINTECH INVESTMENT WITH REGULATION: Investment in Japan’s fintech firms is lagging behind the rest of Asia, with only £31 million ($44 million) invested in the first 9 months of 2015, according to Reuters. For comparison, Chinese fintechs raised £1.9 billion ($2.7 billion) last year, according to KPMG. The reason for low investment in Japanese fintechs is partly due to regulation which prevents banks from buying more than 15% of startups. This is problematic because bank investment is a key source of funding for fintechs in Asia, with corporates participating in 40% of VC deals in 2015. To address this situation, the Japanese Financial Services Authority (FSA), has proposed changes to regulation which will remove limits on how much banks can invest in fintech firms. The changes are due to pass through parliament by May.

This will increase fintech funding and encourage new fintechs to enter the market. Access to funding is one of four top challenges for the fintech industry according to startups. Big banks already want to invest more in fintechs. Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Sumitomo Mitsui Financial Group have all expressed interest, according to Reuters. As funding becomes available, fintech firms will be more likely to enter the market and choose Japan as a base.

FINTECH FIRMS RAISE £153 MILLION ($218 MILLION) IN A WEEK: Last week 28 fintech companies raised a total of £153 million ($218 million), according to Finovate. That brings the total number of deals this year to 313, compared to half of that last year. Volume also doubled, rising to £4.4 billion ($6.3 billion) from £2.2 billion ($3.2 billion) last year.

Fintech funding bounces back. Last year the number of global fintech deals fell consecutively in Q3 and Q4, leading many people to suggest fintech funding was drying up. However, the data from Finovate suggests that may not be true. At its current rate fintech funding would reach £18 billion ($25 billion) by year end.

What do you think? Is fintech in the midst of a funding bubble?

Yes |

No |

Around the world…

SAMSUNG PAY LAUNCHES IN CHINA: Samsung Pay is the second international mobile wallet heavyweight to launch in the country after Apple Pay. The service is being offered through a partnership with China UnionPay, the state-affiliated card network with a near monopoly over Chinese card payments, and nine major banks. Samsung plans to add support for six additional banks in the near future. The mobile wallet faces significant competition from Alipay and Tenpay, which comprise over 90% of the non-bank mobile payments market in the country.

US MOVES TOWARDS FINTECH REGULATION: The US Office of the Comptroller of the Currency (OCC), which oversees the national bank chartering system in the US, announced plans to issue a white paper regarding the regulatory guidelines for fintech innovation this week. The agency hopes that the white paper will serve as a first step in developing a process to approve new fintech business ideas in the US, according to Finextra. Putting such a process in place could have major implications on US fintech, which has thus far remained mostly unregulated.

Correction: In Monday’s edition of Fintech Briefing we incorrectly stated that US-based Patch of Land of was the only alternative lender to focus exclusively on real estate lending. There are other alternative lenders that focus on real-estate lending. We regret the error.